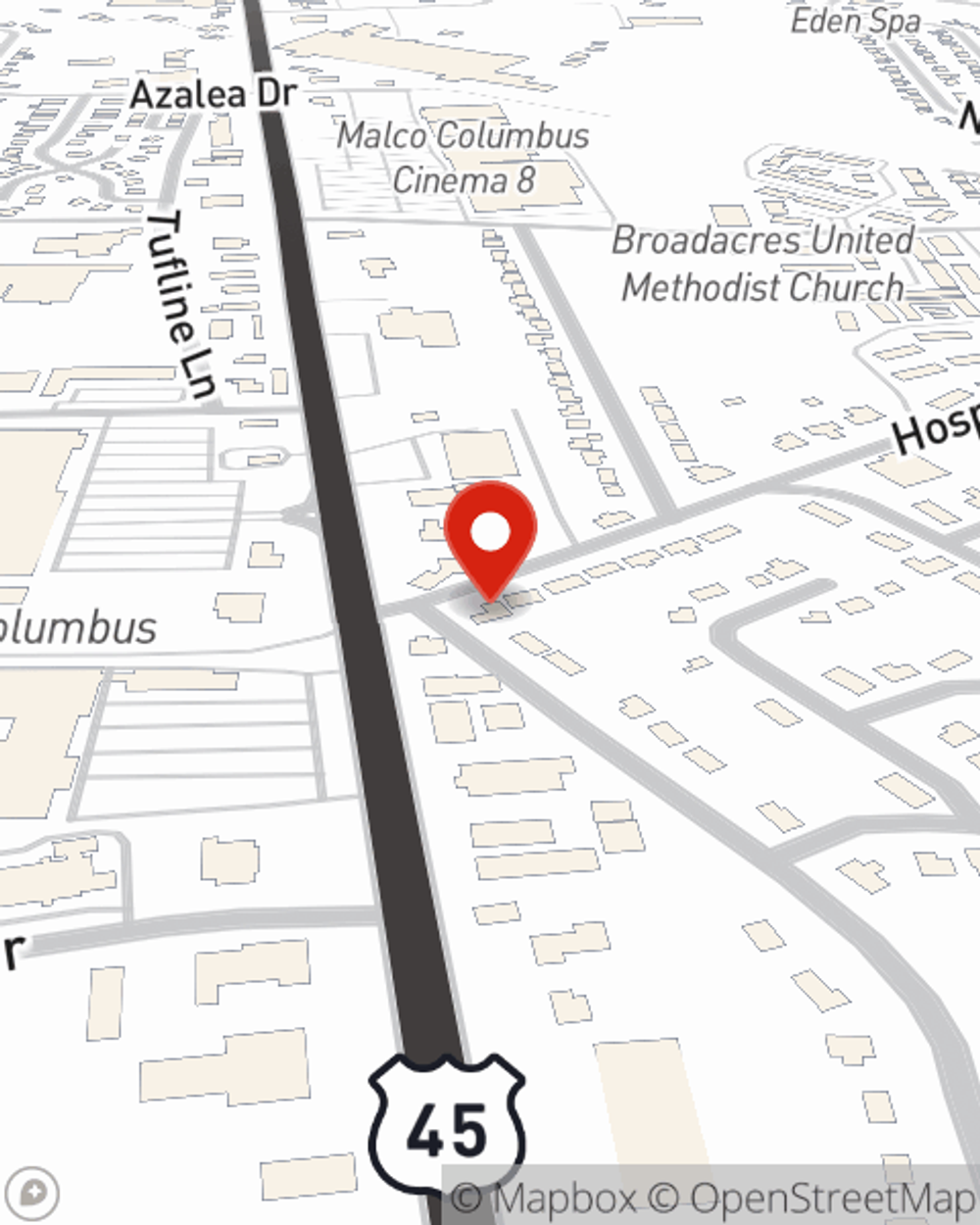

Business Insurance in and around Columbus

Get your Columbus business covered, right here!

Cover all the bases for your small business

- Caledonia

- West Point

- Starkville

- Macon

- Brooksville

- Crawford

Cost Effective Insurance For Your Business.

As a small business owner, you understand that the unexpected happens. Unfortunately, sometimes mishaps like a customer hurting themselves can happen on your business's property.

Get your Columbus business covered, right here!

Cover all the bases for your small business

Strictly Business With State Farm

With options like a surety or fidelity bond, business continuity plans, worker's compensation for your employees, and more, having quality insurance can help you and your small business be prepared. State Farm agent Rob Naugher is here to help you personalize your policy and can assist you in submitting a claim when the unexpected does arise.

Do what's right for your business, your employees, and your customers by getting in touch with State Farm agent Rob Naugher today to identify your business insurance options!

Simple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Rob Naugher

State Farm® Insurance AgentSimple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.