Office Hours

After Hours by Appointment

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health

Other Products

Banking

Rob Naugher

Naugher Ins and Fin Svcs Inc

Office Hours

After Hours by Appointment

Address

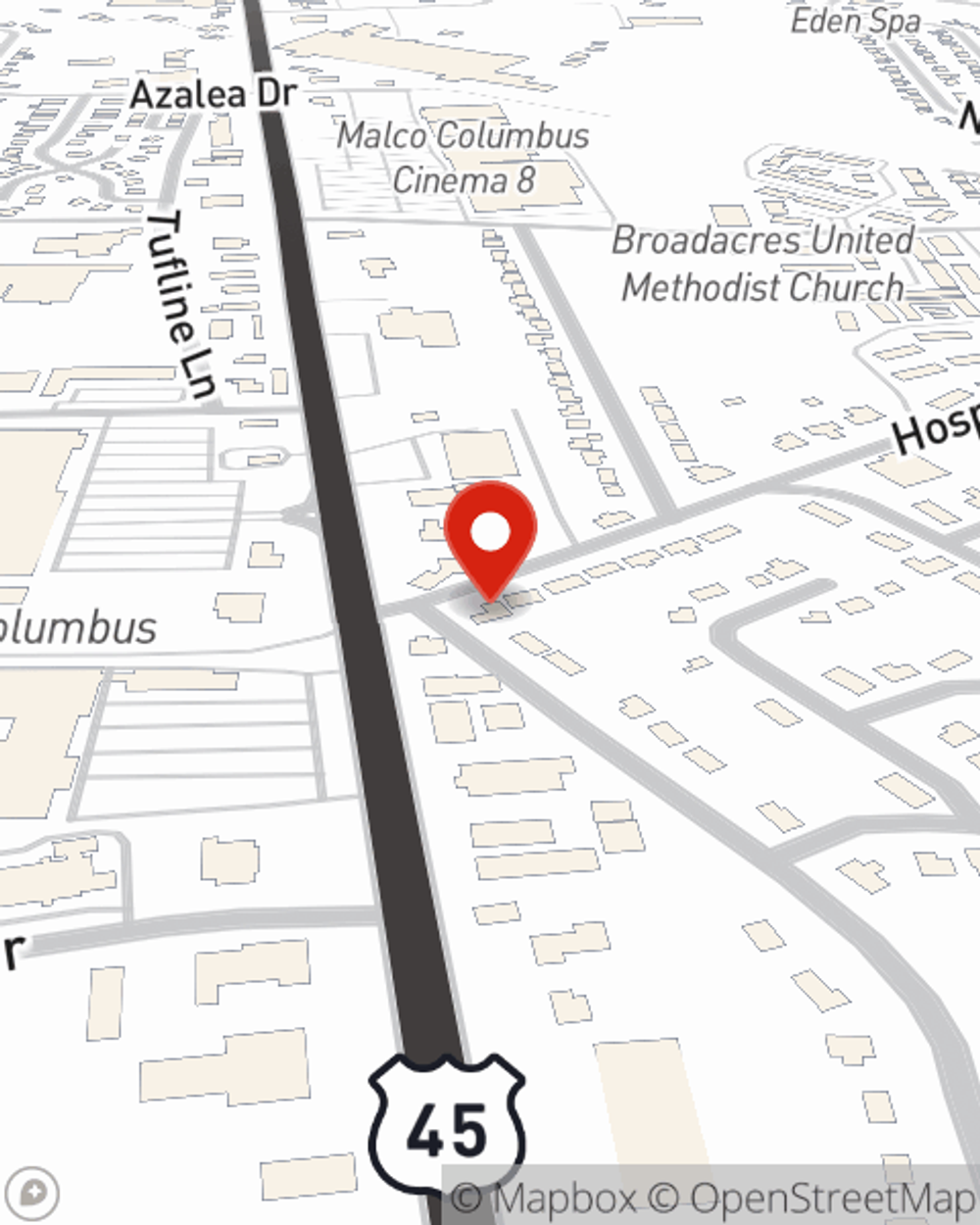

Columbus, MS 39705-1944

Intersection of Highway 45 and Hospital Dr. (across the street from Texaco and Longhorn Steakhouse).

Would you like to create a personalized quote?

Would you like to create a personalized quote?

Office Info

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health

Other Products

Banking

Office Info

Simple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Putting kitchen safety first

Putting kitchen safety first

Practicing kitchen safety can help reduce the chance of cooking-related incidents. Read on for kitchen safety tips you may find helpful for cooking at home.

Social Media

Viewing team member 1 of 3

Tabitha Burns

Office Manager

License #10873117

I have been living in Caledonia, MS my entire life. I started with the Rob Naugher Agency in August of 2022 and I'm licensed in Property & Casualty and Life, Accident and Health insurance (Auto, Home, Health and Life). I love to help our customers ensure their assets are protected all while providing a friendly, personable experience. I also serve as a Notary Public. In my spare time, I enjoy going to the local dirt tracks, boating, and spending time with my husband and 2 sons.

Viewing team member 2 of 3

Kentrilla Johnson

Account Representative

License #10994813

Viewing team member 3 of 3

Pat Werneth

Account Representative

License #10244440

Pat has 6 years insurance experience and is really great at helping customers keep their policies up to-date. Pat enjoys sewing and remodeling homes in her spare time.